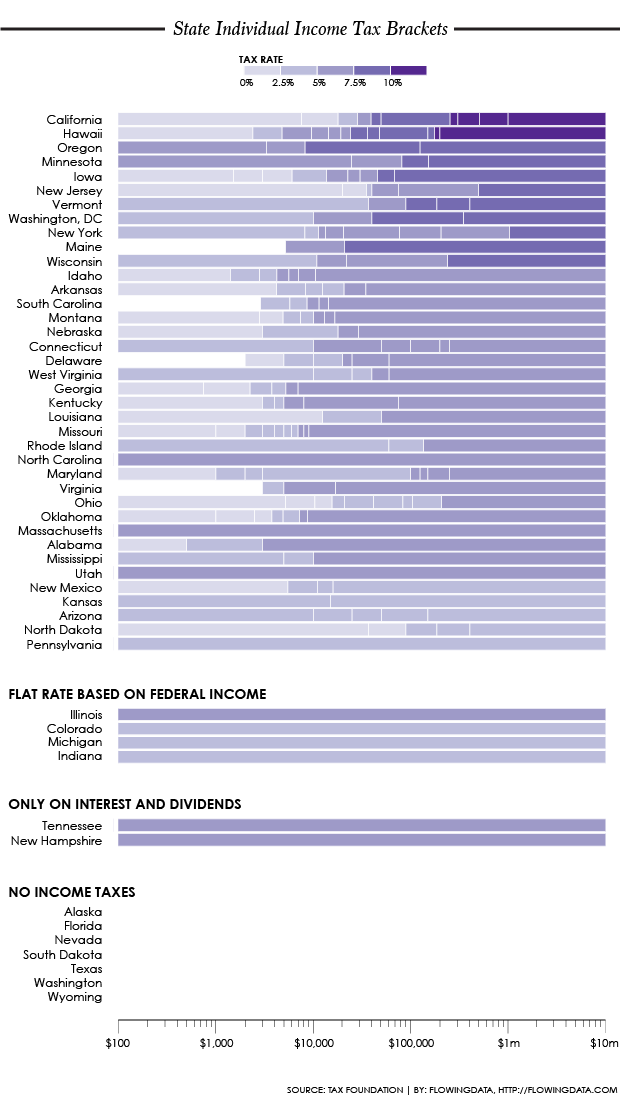

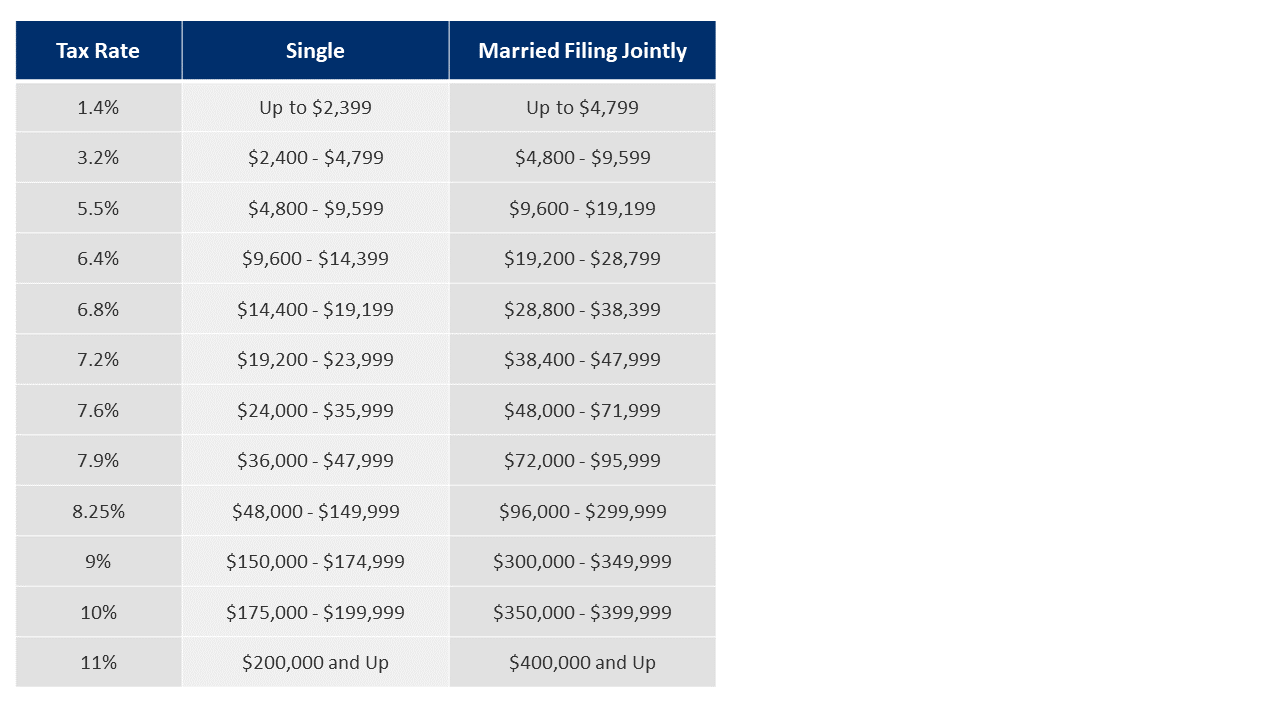

Hawaii Income Tax Brackets 2024

Hawaii Income Tax Brackets 2024. Top marginal rates span from arizona ’s and north dakota ’s 2.5 percent to california. Updated for 2024 with income tax and social security deductables.

The latest tax cuts vetoed by gov. This page has the latest hawaii brackets and tax rates, plus a hawaii income tax calculator.

The District Of Columbia Exempted 97 Percent Of Businesses From Tpp Taxes By Forgoing Less Than 1 Percent Of Its Property Tax Revenue.

A summary of state taxes including information on tax rates, forms.

This Means The Top Portion Of Your Income (All Income Above $191,950) Gets Taxed At 32% For Tax Year 2024.

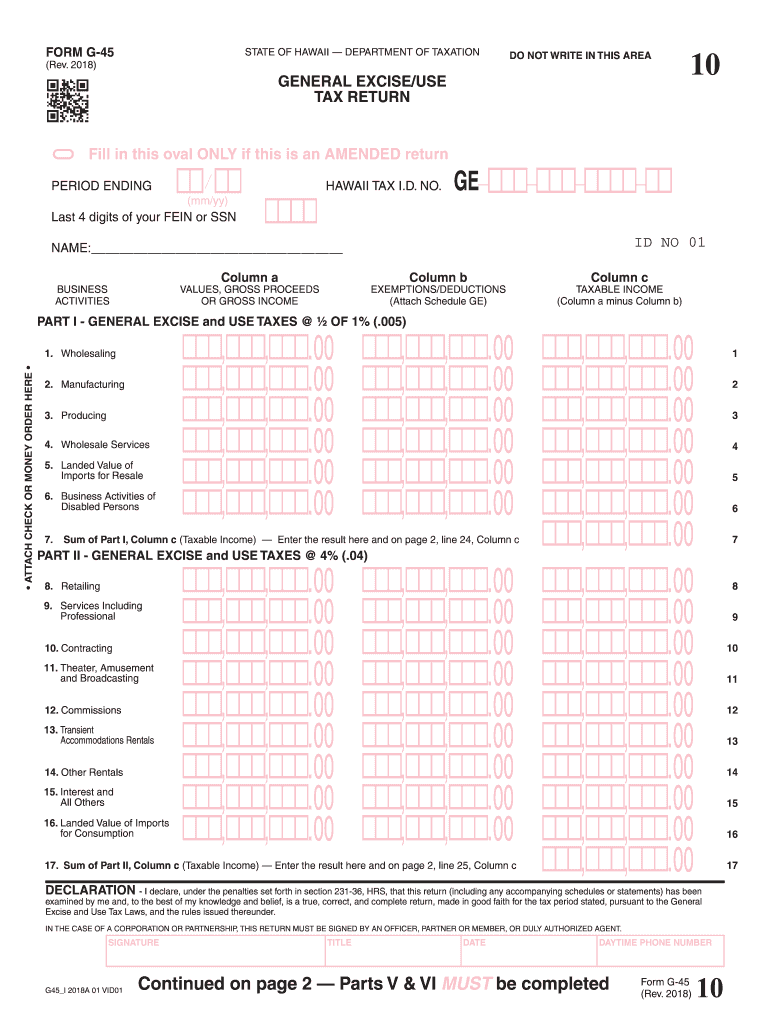

The temporary rules are effective february 16, 2024, and will expire on august 16, 2025.

Updated For 2024 With Income Tax And Social Security Deductables.

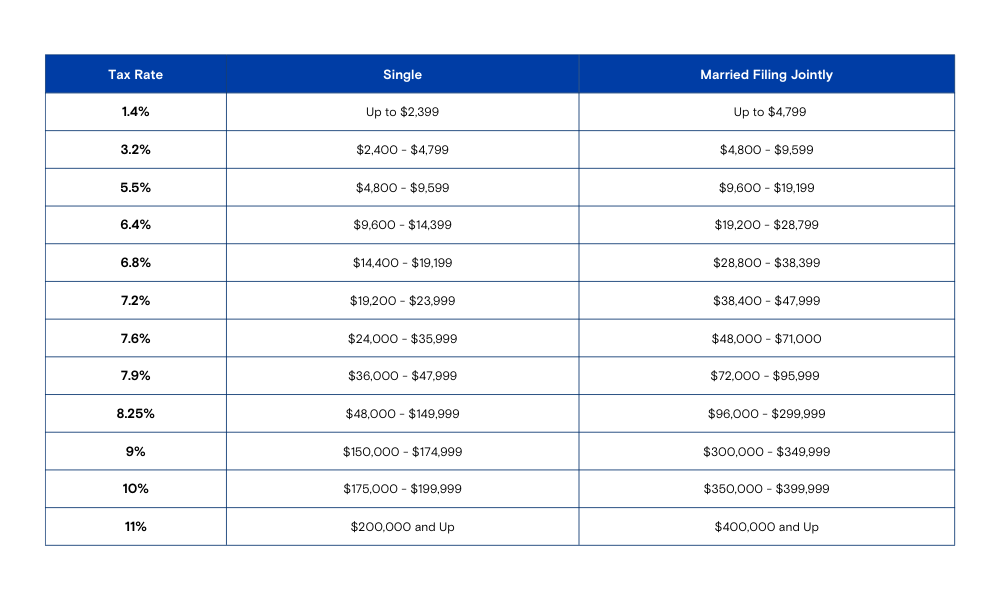

Tax rate taxable income threshold;

Images References :

Source: www.tfhawaii.org

Source: www.tfhawaii.org

State Tax Brackets Charted Tax Foundation of Hawaii, Income from $ 9,600.01 : The district of columbia exempted 97 percent of businesses from tpp taxes by forgoing less than 1 percent of its property tax revenue.

Source: www.boh.com

Source: www.boh.com

What's the Racket about Tax Brackets? A Look at How Tax Brackets Work, Higher tax credits are coming to many hawaii residents next year, representing about $104 million worth of relief targeted for the state’s lowest. These rules are designed to implement and administer hawaii’s new pte.

Source: www.signnow.com

Source: www.signnow.com

Hawaii Tax 20182024 Form Fill Out and Sign Printable PDF, Income from $ 9,600.01 : Needed to accurately file your income tax return by the filing deadline, april 22, 2024.

Source: www.grassrootinstitute.org

Source: www.grassrootinstitute.org

Hawaii tax burden second highest in nation Grassroot Institute, The income from $175,000 to $200,000 is taxed at 10% ($2,500) finally, the remaining income from $200,000 to $350,000 is taxed at 11% ($16,500) adding. Find out the new retirement limits, tax brackets and key benefit changes for 2024.

Source: camqroxanna.pages.dev

Source: camqroxanna.pages.dev

How To Compare Tax Brackets 2024 With Previous Years Fancy Jaynell, Hawaii’s income tax structure is progressive, with rates ranging from 1.4% on the first $2,400 of taxable income for single filers. If you make $70,000 a year living in hawaii you will be taxed $12,413.

Source: us.icalculator.com

Source: us.icalculator.com

Hawaii State Tax Tables 2023 US iCalculator™, Income from $ 2,400.01 : A summary of state taxes including information on tax rates, forms.

Source: calendar.cholonautas.edu.pe

Source: calendar.cholonautas.edu.pe

Tax Rates 2023 To 2024 2023 Printable Calendar, Income from $ 9,600.01 : Income from $ 4,800.01 :

Source: shelbiwlynn.pages.dev

Source: shelbiwlynn.pages.dev

Tax Brackets 2024 Irs Table Alysa Bertina, The federal income tax has. Measures that won preliminary approval in the house finance committee would increase standard deductions and adjust tax brackets for inflation.

Source: www.boh.com

Source: www.boh.com

Bank of Hawaii What's the Racket about Tax Brackets? A Look at How, So, only $8,050 receives this tax. The salary tax calculator for hawaii income tax calculations.

Source: www.hawaiifreepress.com

Source: www.hawaiifreepress.com

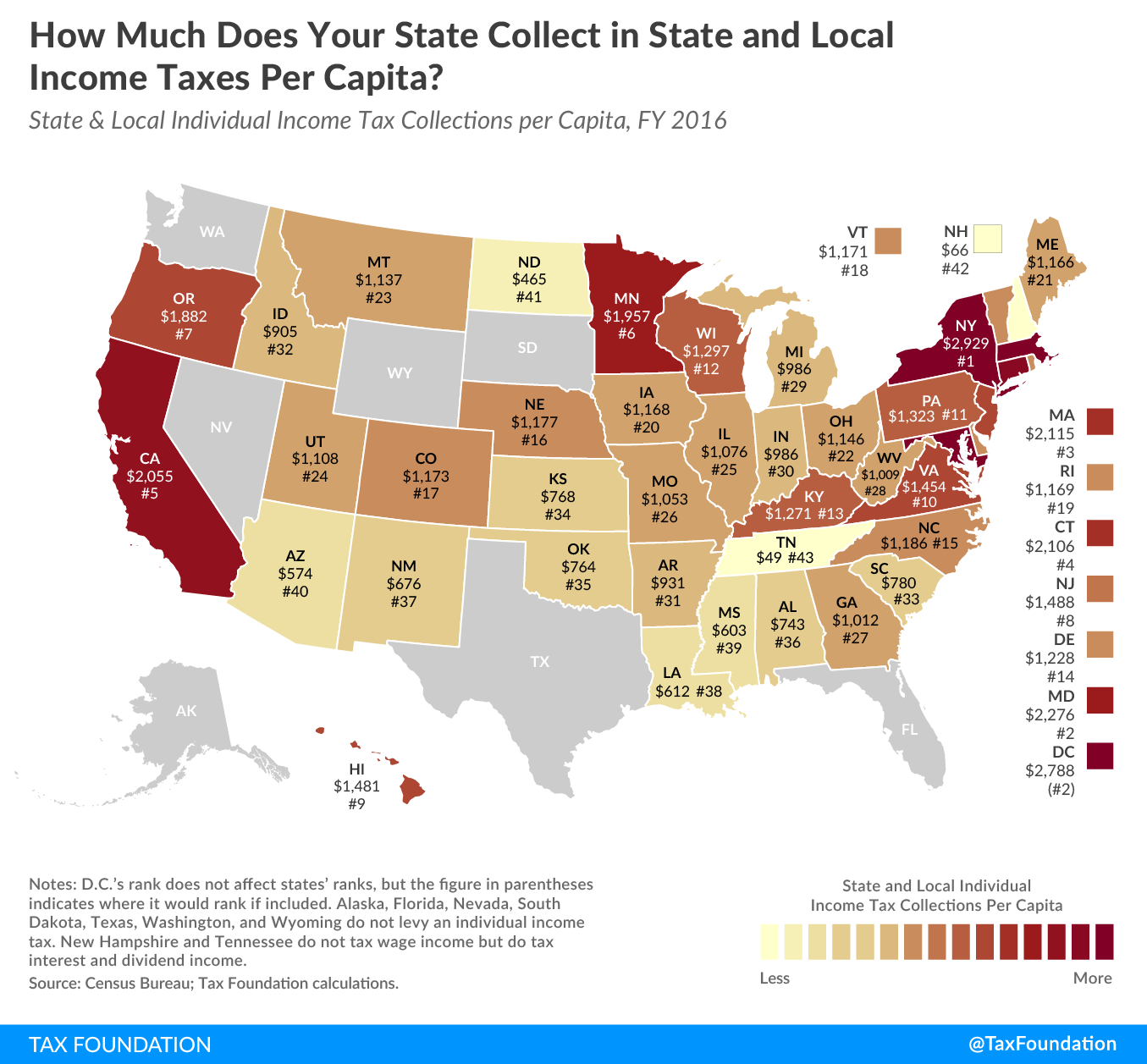

Hawaii State Tax 9th Highest Collection Per Capita > Hawaii Free, The state income tax rate in hawaii is progressive and ranges from 1.4% to 11% while federal income tax rates range from 10% to 37% depending on your. Hawaii state tax quick facts.

Updated For 2024 With Income Tax And Social Security Deductables.

This means the top portion of your income (all income above $191,950) gets taxed at 32% for tax year 2024.

Income From $ 4,800.01 :

Select a specific hawaii tax calculator from the list below to calculate your annual gross salary and net take home pay after deductions for that tax year.

So, Only $8,050 Receives This Tax.

Find out the new retirement limits, tax brackets and key benefit changes for 2024.

Posted in 2024